News & Resources

Posts

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.

FFYF Capsule Collection: Tax Policy and Child Care

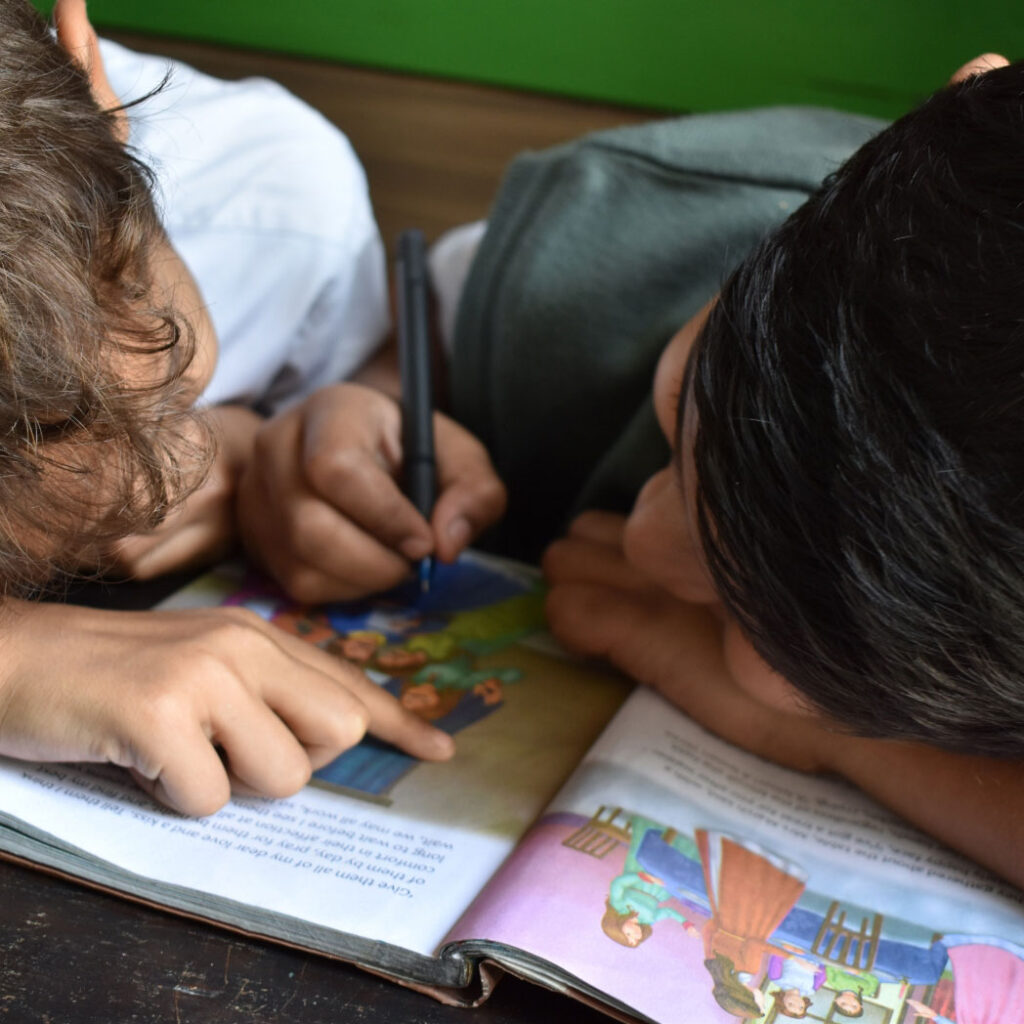

In A Nutshell With two-thirds of children ages five and under living in homes where all available parents are working, child care is not optional for most families – it’s …

The First Five Things to Know About: The Britt-Kaine Bipartisan Child Care Plan

First Introduced: July 2024 Reintroduced: March 2025. Parents want to make child care choices that best support their family’s individual needs and their child’s development. This is especially true for …

Child Care and the Federal Tax Code

Millions of families across the United States need child care. Yet for too many, child care is hard to find and even harder to afford. Congress can lead the way. …

The First Five Things To Know About: The Federal Tax Code and Child Care

Child care is not a luxury for American families – it’s a necessity. Yet the high costs associated with quality child care are rapidly outpacing most other expenses, including the …

The Child Tax Credit and the Child and Dependent Care Tax Credit — Understanding the Difference

The Child and Dependent Care Tax Credit and the Child Tax Credit support families in very different ways. Families need both. Child care is not a luxury for American families …

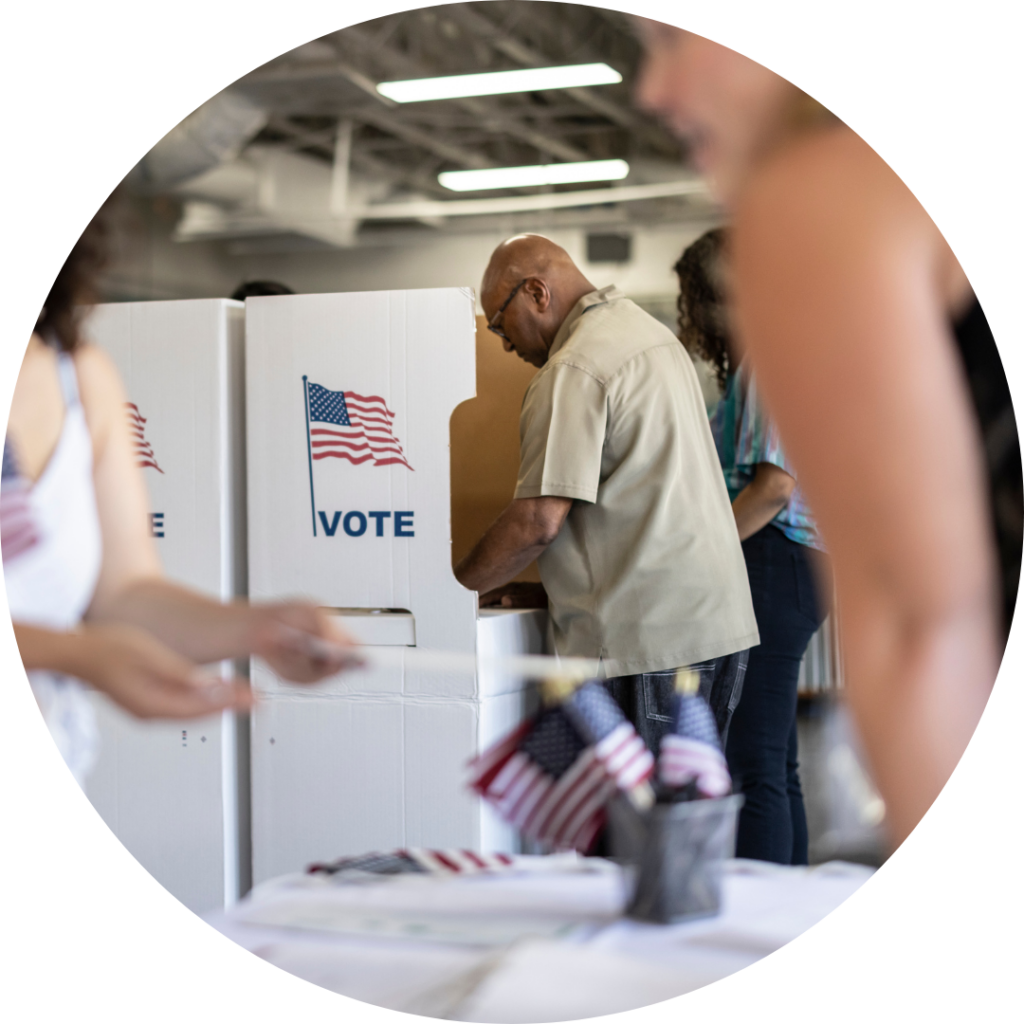

The First Five Things To Know About: A New Poll Showing Voter Support For Child Care Funding

In July 2023, Public Opinion Strategies completed a poll on behalf of the First Five Years Fund, examining voter attitudes toward the issue of child care and early childhood education …