The Child Tax Credit (CTC) helps qualifying parents with children under the age of 17 offset the cost of everyday household expenses.

The CTC is designed to ensure that the tax code reflects the fact that families have more expenses and less disposable income than individuals and couples with the same income who don’t have children. Parents can use this credit for any expense, even those unrelated to the cost of raising children.

In July of 2025, Congress increased the Child Tax Credit from $2,000 to $2,200 per qualifying child.

Resource

July 12, 2025

In A Nutshell With two-thirds of children ages five and under living in homes where all available parents are working, child care is not optional for most families – it’s …

Resource

March 5, 2025

First Introduced: July 2024 Reintroduced: March 2025. Parents want to make child care choices that best support their family’s individual needs and their child’s development. This is especially true for …

Resource

February 18, 2025

Millions of families across the United States need child care. Yet for too many, child care is hard to find and even harder to afford. Congress can lead the way. …

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what’s happening in early childhood education.

News

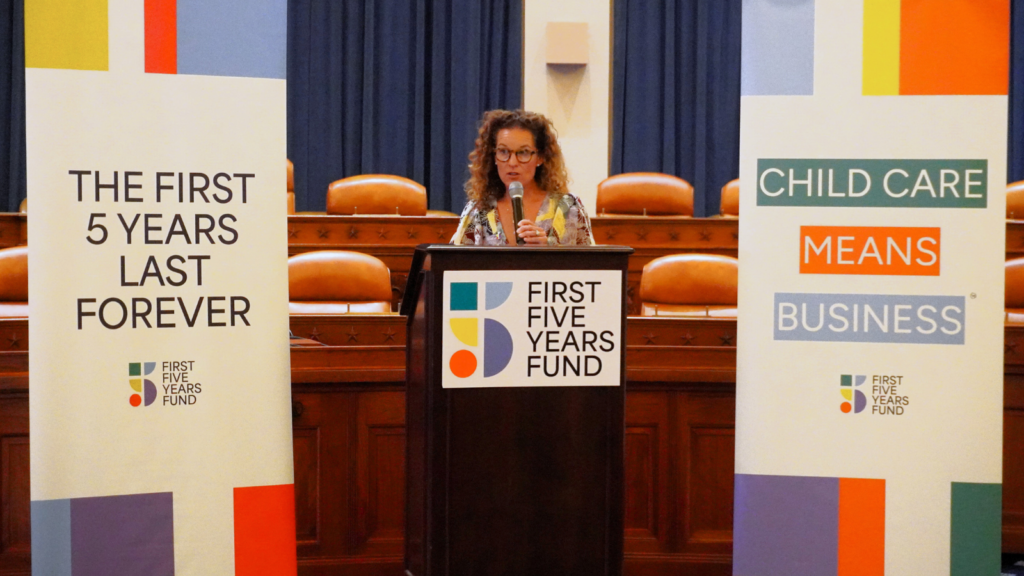

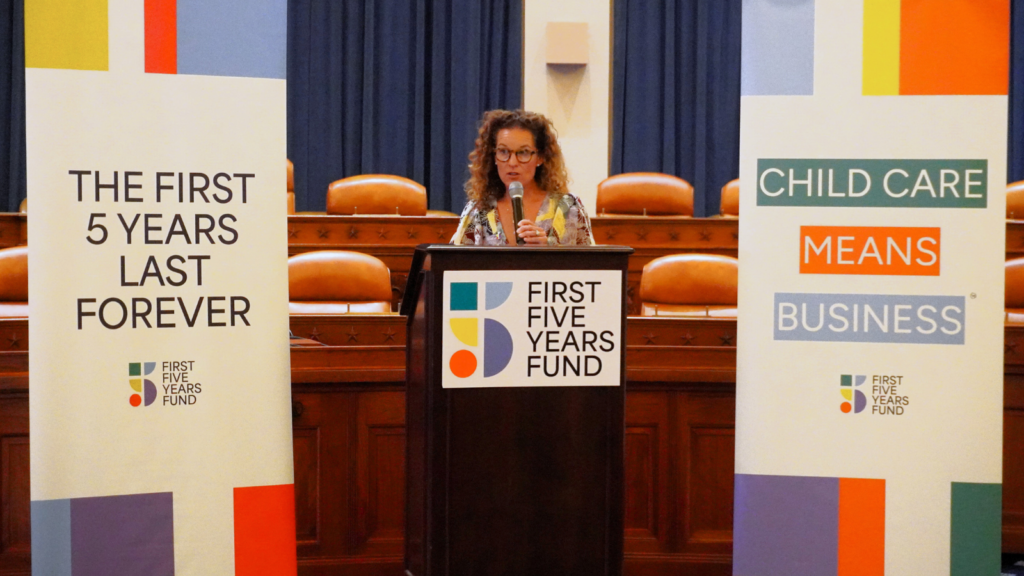

June 6, 2024

On June 4th, First Five Years Fund, in conjunction with the Bipartisan Pre-K and Child Care Caucus, hosted lawmakers, bipartisan Congressional staffers, and early learning advocates for a “Child Care …

News

January 30, 2024

By enhancing the Child Tax Credit, the bipartisan Tax Relief for American Families and Workers Act of 2024 would help more families afford the everyday expenses of raising children. The …

Can’t find what you’re looking for? Contact our policy team directly at mail@ffyf.org for more info.