Child and Dependent Care Tax Credit (CDCTC): Overview

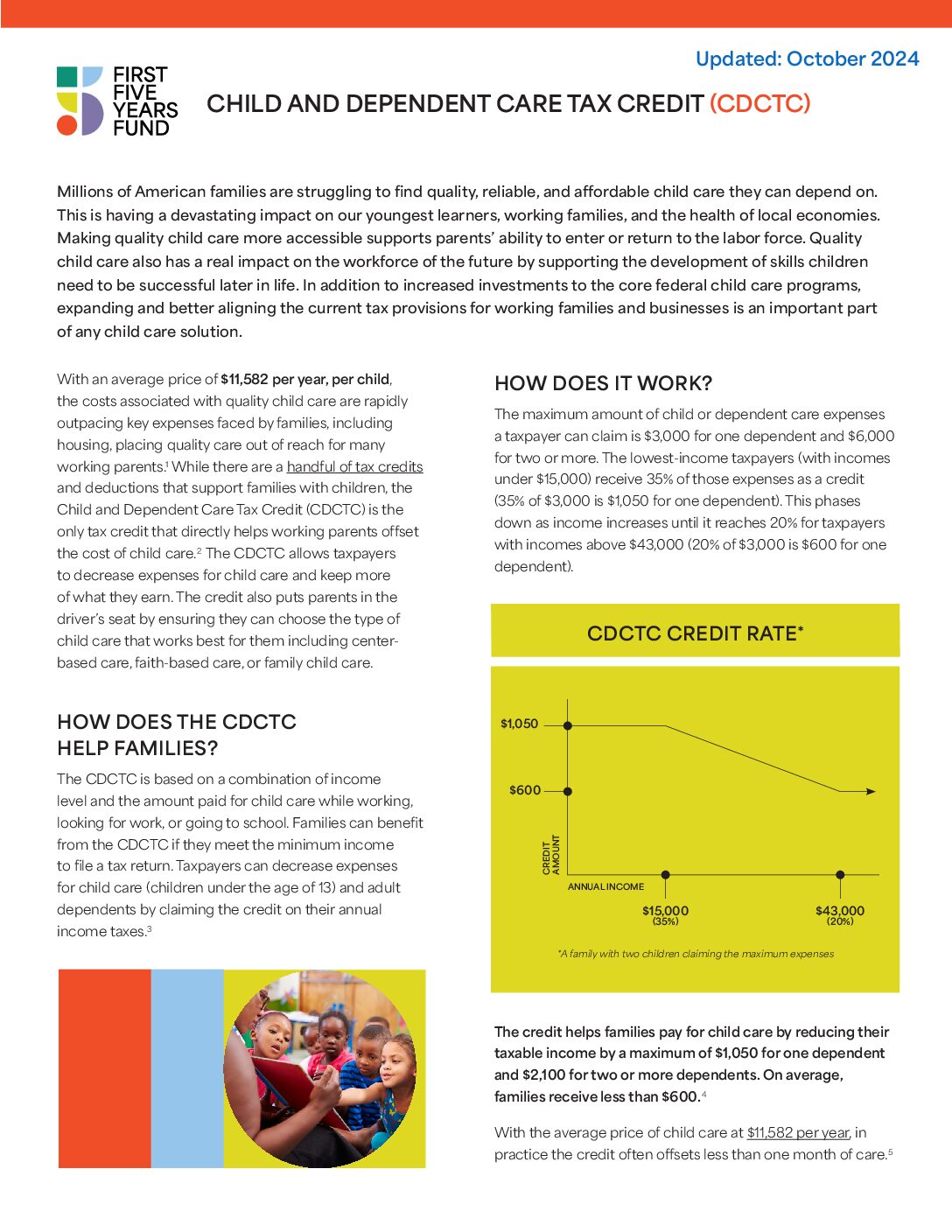

With the average annual cost exceeding $13,000 per child, millions of American families struggle to afford quality child care. The Child and Dependent Care Tax Credit (CDCTC) provides some financial relief by allowing families to claim a portion of their child care expenses on their federal tax return.

It is the only federal tax credit specifically created to help working families offset child care costs. Learn more below.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.