TOPLINES: Child Care in the 2025 Tax Reconciliation Package

The final version of the 2025 tax reconciliation package (also known as H.R.1) was signed into law on July 4th, 2025. The bill permanently improves three pieces of tax policy that help make child care more affordable for working families with young children.

These changes:

- Expand the Child and Dependent Care Tax Credit (CDCTC), the only tax credit that specifically helps working parents offset the cost of child care (last updated in 2001);

- Improve the Employer-Provided Child Care Credit (45F), which supports businesses who want to help locate or provide child care for their employees (last updated in 2001);

- Grow Dependent Care Assistance Plans (DCAP), flexible spending accounts that allow working parents to set aside pre-tax dollars to pay for child care expenses (last updated in 1986).

In the United States, two-thirds of children ages five and under are living in homes where all available parents are working. This means child care is not optional for most families – it’s essential. Child care-related tax breaks can help parents offset the cost of care, but they hadn’t been updated in decades. The new law includes a $16 billion investment in child care-related tax credits through permanent increases and enhancements to three provisions currently in the U.S. tax code.

Overwhelming Support

FFYF polling shows that there is overwhelming bipartisan support for expanding all three child care tax credits.

- Support for expanded CDCTC in a national 2025 poll – 86% overall, with 83% of Republicans, 83% of Independents, and 91% of Democrats.

- Support for expanded 45F and DCAP in a national 2024 poll – 84% overall, with 76% of Republicans, 82% of Independents, and 93% of Democrats.

Here’s a look:

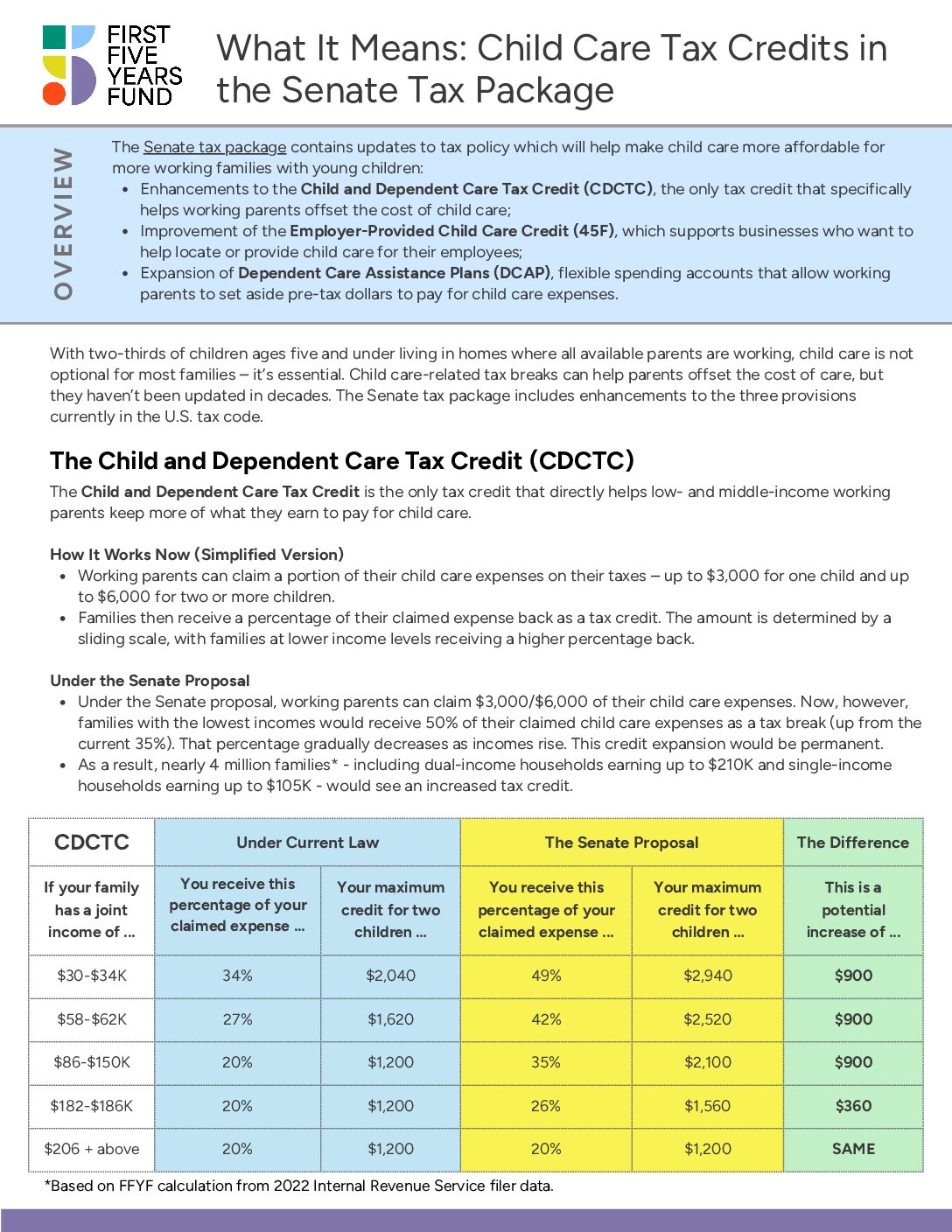

The Child and Dependent Care Tax Credit (CDCTC)

The Child and Dependent Care Tax Credit is the only tax credit that directly helps low- and middle-income working parents keep more of what they earn to pay for child care. More on the tax break that parents may receive from the updated CDCTC here.

Previously

- Working parents could claim a portion of their child care expenses on their annual taxes – up to $3,000 for one child and up to $6,000 for two or more children.

- Families then received a percentage of their claimed expense back as a tax credit. The amount was determined by a sliding scale, with families at lower income levels receiving a higher percentage back – starting at 35%.

The New Law

- Allows working parents to claim $3,000/$6,000 of their child care expenses. Families with the lowest incomes will now receive a maximum credit of 50% of their claimed child care expenses. That percentage gradually decreases as incomes rise.

- Will result in nearly 4 million families* – including dual-income households earning up to $206K and single-income households earning up to $103K – seeing an increased tax credit.

*Based on FFYF calculation from 2022 Internal Revenue Service filer data.

(On mobile devices, tables are best viewed horizontally.)

| Details | Previously | The New Law | The Difference | ||

| Your family’s income (married filing jointly): | Percentage of your claimed expense: | Maximum credit for two children: | Percentage of your claimed expense: | Maximum credit for two children: | This is a potential increase of … |

| $33-$35K | 25% | $1,500 | 40% | $2,400 | $900 |

| $43-$150K | 20% | $1,200 | 35% | $2,100 | $900 |

| $182-$186K | 20% | $1,200 | 26% | $1,560 | $360 |

| $206K + | 20% | $1,200 | 20% | $1,200 | SAME |

Employer-Provided Child Care Credit (45F)

The Employer-Provided Child Care Credit (45F) supports businesses who want to help locate or provide child care for their employees.

Previously

- Businesses received a maximum tax credit of $150,000 (based on 25% of their qualified child care expenses). To receive the maximum credit, businesses needed to spend $600,000 on child care-related expenses.

The New Law

- Increases the maximum credit and credit rate, providing more of an incentive for businesses to participate. It also indexes the credit to inflation.

- Grows the credit rate and maximum credit specifically for small businesses.

- Simplifies the process for multiple employers to jointly contract with a qualified child care provider.

(On mobile devices tables are best viewed horizontally)

| Details | Previously | The New Law |

|---|---|---|

| % of child care expenses covered | 25% | 40% for larger businesses, 50% for small businesses |

| Maximum Credit | $150,000 | $500,000 for larger businesses $600,000 for small businesses |

| Allows small businesses to pool resources to contract with a qualified child care provider | No | Yes |

Dependent Care Assistance Plans (DCAP)

Dependent Care Assistance Plans (DCAP) allow working parents to set aside pre-tax income to pay for child care in an employer-offered flexible spending account (similar to health spending accounts).

Previously

- Families whose employer participated in DCAP could exclude up to $5,000 per year from their pre-tax earnings to pay for dependent care expenses.

The New Law

- Increases the amount of pre-tax income families can exclude from wages to $7,500 annually.

(On mobile devices tables are best viewed horizontally)

| Details | Previously | The New Law |

|---|---|---|

| Pre-tax amount a household can exclude from wages to use on child care expenses through an employer offered flexible spending account | $5,000 | $7,500 |

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.