Tax Code

Posts

The First Five Questions For: Caitlin Codella and Liat Krawczyk

In this month’s FFYF’s First Five Questions series – which brings together interesting leaders, experts, and voices together to talk about child care challenges and solutions – Executive Director Sarah …

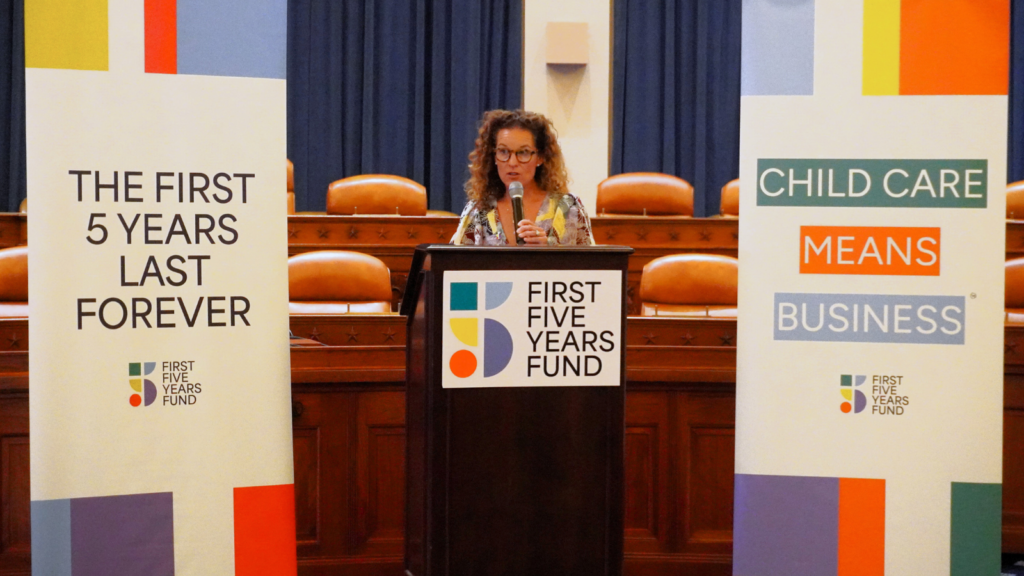

FFYF & Bipartisan Pre-K and Child Care Caucus Host “Child Care Means Business” Event

On June 4th, First Five Years Fund, in conjunction with the Bipartisan Pre-K and Child Care Caucus, hosted lawmakers, bipartisan Congressional staffers, and early learning advocates for a “Child Care …

First Five Questions For Reps. Tenney and Schneider

WASHINGTON, D.C. – The First Five Years Fund (FFYF) hosted Congresswoman Claudia Tenney (R-NY) and Congressman Brad Schneider (D-Il) as part of our First Five Question Series – a monthly …

The First Five Things to Know About: The Child Care Investment Act 2023

Millions of working families with young children need quality child care, but affordable, reliable options can be hard to find. Without it, many parents are forced to miss work or …

Employer-Provided Child Care Credit (45F): Overview

Millions of American families are struggling to find quality, reliable, affordable child care they can depend on. This is having a devastating impact on our youngest learners, working families, and …

Dependent Care Assistance Program (DCAP): Overview

Millions of American families are struggling to find quality, reliable, affordable child care they can depend on. This is having a devastating impact on our youngest learners, working families, and …

New: Bipartisan Bill to Strengthen Child Care Tax Incentives Introduced

The New PACE Act: Today, U.S. House Reps. Claudia Tenney (R-NY) and Brad Schneider (D-IL) introduced the Promoting Affordable Childcare for Everyone (PACE) Act, a bill to enhance existing provisions …

Co-Chairs of the Bipartisan Child Care and Pre-K Caucus Call For Updating Tax Provisions to Help Working Families Find and Afford Child Care

Leaders of the Bipartisan Pre-K and Child Care Caucus sent a letter to the Ways and Means Committee, urging their colleagues to update provisions of the United States tax code …

FFYF hosts event with Business Leaders, Reps. Carbajal and Chavez-DeRemer to Talk Tax, Child Care

The First Five Years Fund (FFYF) and Hollis Silverman (founder and owner of Eastern Points Collective) hosted Reps. Salud Carbajal (D-CA) and Lori Chavez-DeRemer (R-OR), child care experts, employers, and …

Rep. Salud Carbajal to Ways And Means: Update Tax Code, Help More Parents Find and Afford Child Care

This week, the House Ways and Means Committee hosted “Member Day,” an annual hearing open to all members of the House of Representatives to come and speak on legislative ideas, …

Bipartisan Bill Seeks to Leverage Existing Tax Credits to Support Working Parents and Employers in Accessing Child Care

Last week, Rep. Salud Carbajal (D-CA) and Rep. Lori Chavez-DeRemer (R-OR) introduced H.R. 4571, the Child Care Investment Act of 2023, which would enhance three existing tax credits to address …

The First Five Things to Know: The Child and Dependent Care Tax Credit

For millions of working parents with small children, child care is a major expense. It is also a necessary expense, as many parents are unable to work without it. The …